What happens when your marriage breaks down after you and your ex have already “BTO-ed”?

Generally, the deeper in you are in the process, the higher the penalties may be.

This article will discuss what you lose out on based on which stage of the BTO application process you’re at.

There are 4 main stages in a BTO application process:

The numbers used in this article will be based on the price of a 4-room BTO HDB flat during the recent Sembawang February 2020 BTO Sales Launch (starting from $272,000, excluding grants).

For the purposes of a case study, the flat will be assumed to have been purchased with a HDB Housing Loan and be under the Staggered Down payment Scheme.

Breaking up after only completing Stage 1: Application

| What do I lose? | What happens if I wish to apply for another BTO HDB flat? | |

| BTO Application Fee | $10 |

|

If you decide to breakup early in the application process, the only financial loss you will incur is the non-refundable application fee of $10.00.

However, you also gain a strike against your first-timer priority – if you were invited to select a flat but did not do so even though there were units available, you would be considered as having rejected to select a flat once.

Gain another strike and your first-timer priority will be revoked for a year. If you think this is inconsequential, think again: first-timer privileges include enjoying greater priority when applying for a new HDB flat, including:

- Having a higher proportion of flat supply allocated to you

- More ballot chances

- Additional ballot chances following unsuccessful BTO applications

- May be eligible for the Staggered Down payment Scheme, which allows you to pay your down payment in 2 installments after you sign the Agreement for Lease (which could help you in paying for a new flat!)

Additionally, you won’t be able to apply for the Enhanced CPF Housing Grant (“EHG”) down the road since it’s available only to first-timer households. The EHG could potentially reduce the flat price from up to $80,000, which is no small sum for young families with an entry-level salary.

Apart from that, you lose all the additional ballot chances you accumulated from your previous unsuccessful BTO applications the moment you cancel your application.

This could make it a lot harder for a successful ballot the next time around, especially when the success rate only lingers around 10% each round.

For instance, in the most recent BTO Sales Launch, 20,252 applicants vied for 2,088 flats; only 1 in 10 was successful. Without the additional ballot chances, it would be extremely difficult for you to get a flat the next time.

Total amount payable: $10.00

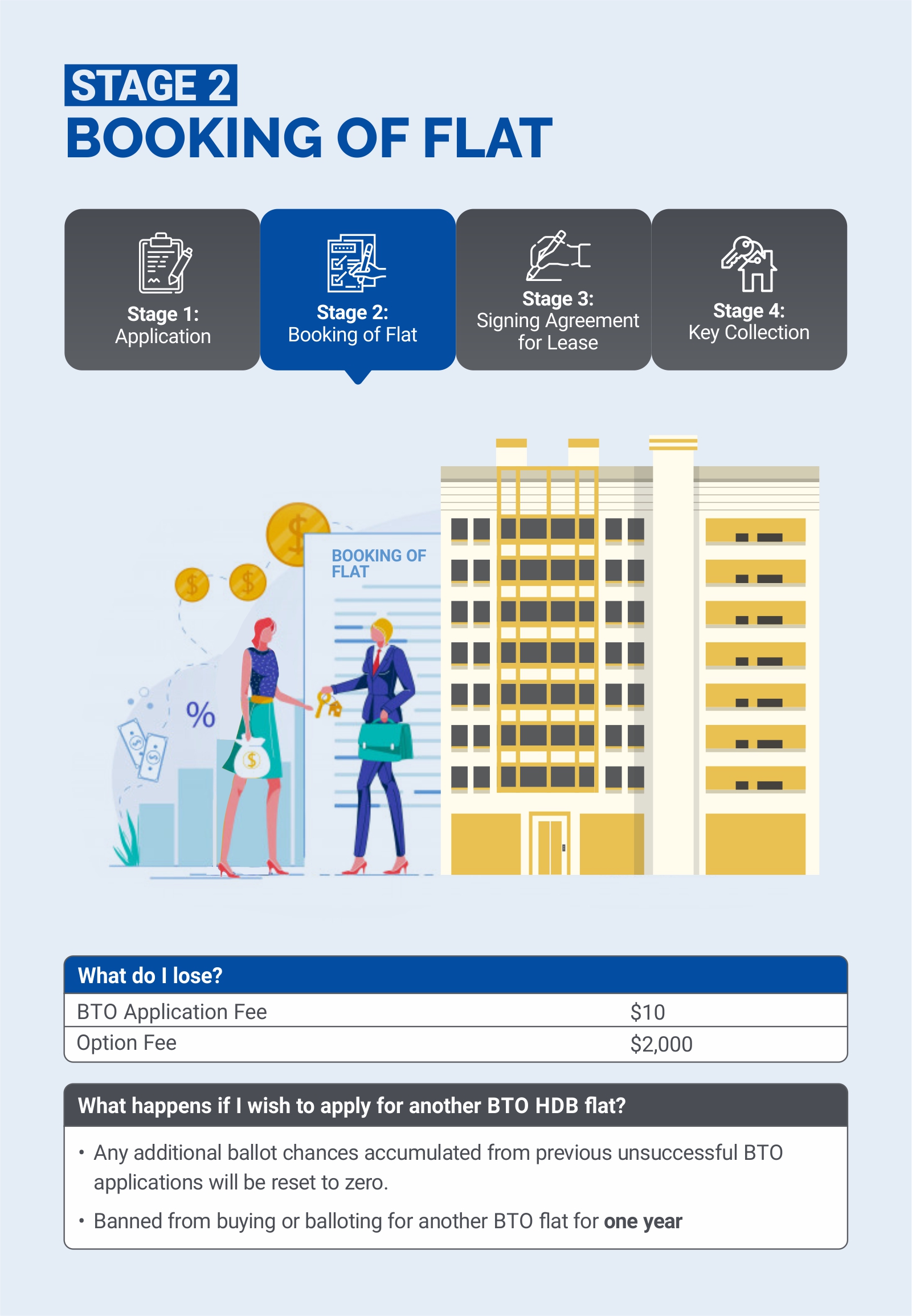

Breaking up after only completing up to Stage 2: Booking

| What do I lose? | What happens if I wish to apply for another BTO HDB flat? | |

| BTO Application Fee | $10 |

|

| Option Fee | $2,000 | |

In addition to the application fee, couples who break up and bail out after booking but before signing the Agreement of Lease will lose their option fee as well. The option fee varies depending on the flat type that was booked.

| Flat type | Option Fee Payable |

| 2-room Flexi flat | $500 |

| 3-room | $1,000 |

| 4/5-room and Executive Flat | $2,000 |

The total amount you lose at this stage is relatively little compared to if you bailed out at later stages, but it’s no small sum either.

Perhaps what is the biggest problem about breaking up and defaulting on your BTO application at this stage is that you will not be allowed to apply to buy or ballot for another HDB flat for one year.

Also, the next time you decide to ballot for a flat, whether as a single or with a new love, all additional chances accumulated from previous unsuccessful applications will be reset to zero, so you might find it much harder to get a flat.

Total amount payable: $2,010.00 (for a 4-room flat)

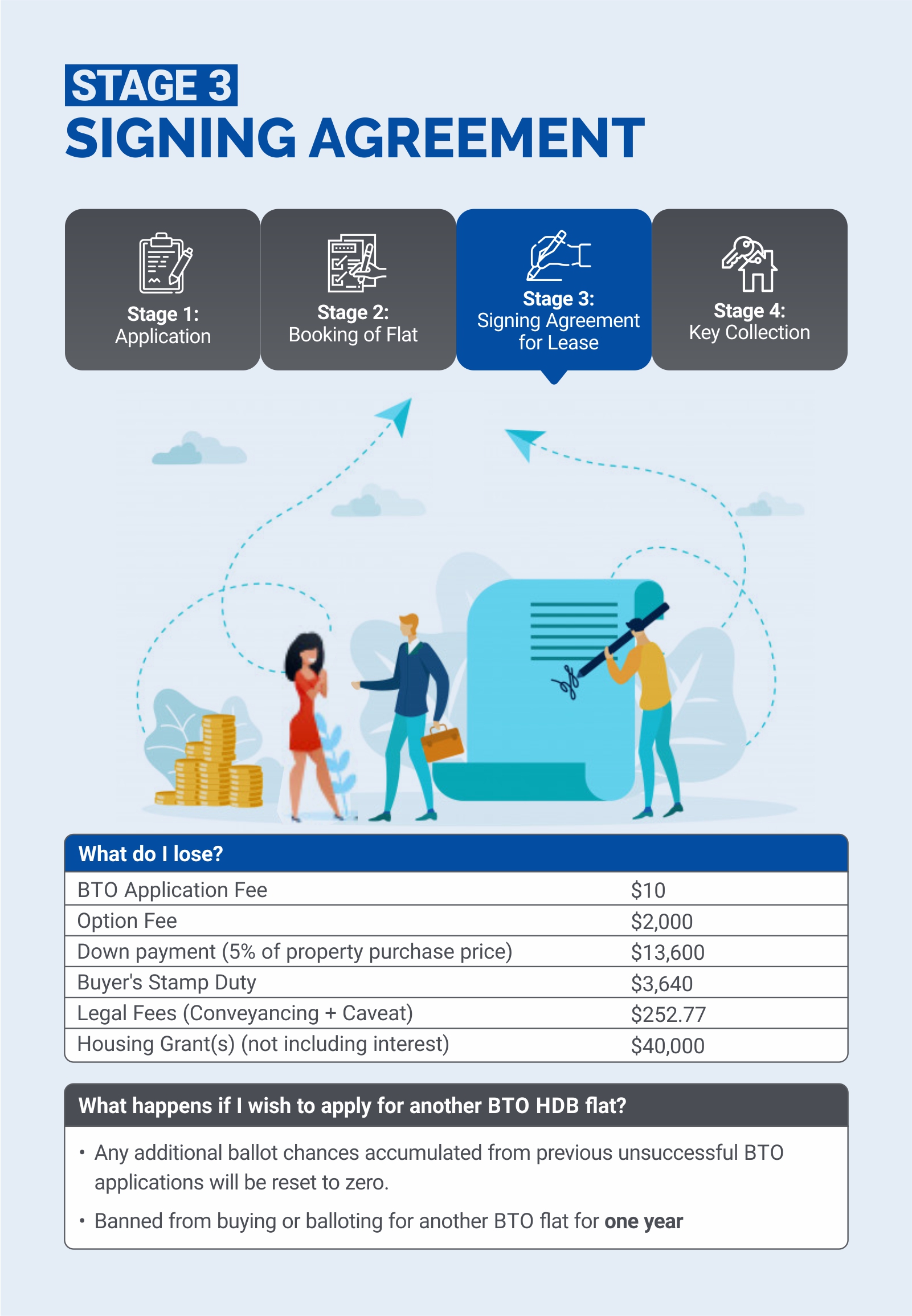

Breaking up after completing up to Stage 3: Signing of Lease Agreement

By this stage, the stakes would be a lot higher.

| What do I lose? | What happens if I wish to apply for another BTO HDB flat? | |

| BTO Application Fee | $10 |

|

| Option Fee | $2,000 | |

| Down payment (5% of property purchase price) | $13,600 | |

| Buyer’s Stamp Duty | $3,640 | |

| Legal Fees (Conveyancing + Caveat) | $252.77 | |

| Housing Grant(s) (not including interest) | $40,000 | |

Down payment

Depending on the type of loan you take (if any) and whether you qualify for the Staggered Down payment Scheme, the down payment you would have made would range from 5% to 20% of the property purchase price.

To elaborate: if you are taking a HDB housing loan/not taking any loans, you would have paid 10% of the purchase price (or 5% under the Staggered down payment Scheme) upon signing.

Those taking bank loans would have paid 20% of the purchase price instead (or 10% if under the Staggered down payment Scheme).

Using the figures of the sample case study (property price of $272,000), that would amount to $13,600. If you took a bank loan instead, you would have paid $27,200 instead.

Buyer’s Stamp Duty

Using the Inland Revenue Authority of Singapore’s (“IRAS”) Stamp Duty Calculator, you would need to pay $3,640 for the Buyer’s Stamp Duty of your 4-room flat in Sembawang. The formula is as follows:

| Amount | Percentage of Purchase Property Price |

| First $180,000 | 1% |

| Next $180,000 | 2% |

| Next $640,000 | 3% |

| Remaining amount | 4% |

Note that you can get a refund of stamp duty paid upon cancellation of flat application with either your own solicitor or HDB’s solicitor assistance.

Our friendly Singapore divorce lawyers are experienced in such dealings and can advise you accordingly.

Legal Fees

Legal fees would include both Conveyancing Fees and Caveat Registration Fees.

Conveyancing fees are calculated as follows. The price calculated is subject to GST, and the minimum conveyancing fee chargeable is $20.

| BTO Purchase Price | Conveyancing Fee |

| First $30,000 | $0.90 per $1,000 |

| Next $30,000 | $0.72 per $1,000 |

| Remaining amount | $0.60 per $1,000 |

Based on the HDB Legal Fees Enquiry Calculator, you’ll need to pay $188.32 (inclusive of GST) for the Conveyancing Fee.

The Caveat Registration Fee of $64.45 (inclusive of GST) will also be payable when you sign the Agreement for Lease.

This brings the total legal fee to a sum of $252.77.

Housing Grants

Any grants you get, such as the EHG, would also have to be returned with interests. Assuming your combined average monthly household income is $5,500, this means that you would have to return the amount of $40,000 plus interest.

Note that even though this amount did not come out of pocket and is a grant by the government, there is still a net loss because you’ll lose out on the initial grant amount which you would have gotten to enjoy as a first-time buyer.

To illustrate, a couple who is a first-timer applicant can get up to $80,000 in EHG grants, depending on their combined average monthly income.

The same does not apply for “first-timer and second-timer couple applicants”, whereby one party has applied for a BTO before while the other is a first-timer.

The first-timer partner can only apply for the EHG (Singles) Grant, where they can only get up to $40,000 in EHG grants.

A second-timer BTO applicant can only for the Half Housing Grant, which grants only up to $25,000 for a 4-room flat and $20,000 for a 5-room flat.

The maximum that such a couple can get is then $65,000, which is $15,000 less than first-timer couples!

The amount lost due to a breakup at this stage is a significant sum for many. With the sum of money lost in this example, one could buy 16,829 plates of chicken rice (which is enough to feed one person for 3 meals everyday for 15 years, assuming no inflation)!

Total amount lost: $58,902.77 (not including interest for EHG)

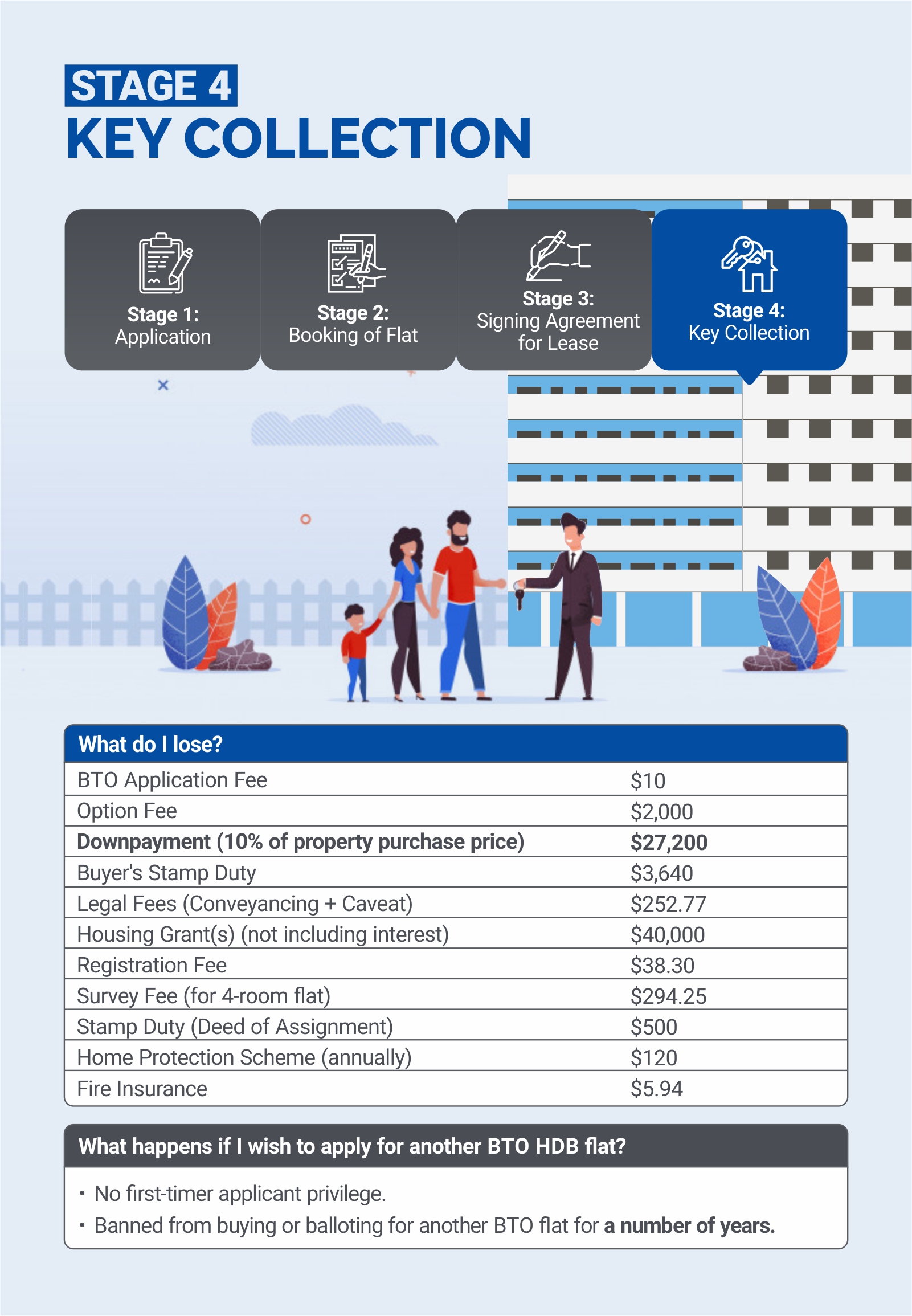

Breaking up after completing Stage 4: Key Collection

By the time you reach this stage, your problems probably extend further than just how much money you will be losing.

You are now looking at the possibility of not having a home at all– depending on whether you have reached the Minimum Occupation Period (“MOP”) of 5 years, you might be forced to give up your HDB flat.

The MOP is calculated from the date you collect the keys to your flat and excludes any period when you do not occupy the flat.

Breaking up before reaching the MOP

| What do I lose? | What happens if I wish to apply for another BTO HDB flat? | |

| BTO Application Fee | $10 |

|

| Option Fee | $2,000 | |

| Down payment (10% of property purchase price) | $27,200 | |

| Buyer’s Stamp Duty | $3,640 | |

| Legal Fees (Conveyancing + Caveat) | $252.77 | |

| Housing Grant(s) (not including interest) | $40,000 | |

| Registration Fee | $38.30 | |

| Survey Fee (for 4-room flat) | $294.25 | |

| Stamp Duty (Deed of Assignment) | $500 | |

| Home Protection Scheme (annually) | $120 | |

| Fire Insurance | $5.94 | |

If you break-up and default on your BTO flat after you’ve collected the keys but before you satisfy the MOP requirement, you will not be allowed to retain the flat.

Not only will you have to return the flat to HDB (who might offer you some compensation at their discretion), you will also be barred from buying or balloting for another HDB flat for a number of years.

This will effectively put you out of owning your very own home— that is unless you can afford the private property since this bar includes resale flats and executive condominiums as well.

Registration Fee

There are two types of registration fees:

- Lease In-Escrow registration fee of $38.30 (fixed amount): Paid if HDB acts for you in the flat purchase.

- Mortgage In-Escrow registration fee of $38.30 (fixed amount): Paid if HDB acts for you in the mortgage.

Survey Fee

The survey fee is based on your flat type and is subject to GST.

| Flat Type | Survey Fee (Before GST) |

| 1-Room/2-Room | $150 |

| 3-Room | $212.50 |

| 4-Room | $275 |

| 5-Room | $325 |

| Executive Flat | $375 |

Expect to lose the amount of $294.25 (inclusive of GST) for a 4-room flat.

Stamp Duty on Deed of Assignment

The stamp duty on Deed of Assignment is payable if you are taking a housing loan. It is calculated at 0.4% of the loan amount, subject to a maximum of $500.

Assuming you take a housing loan of $150,000, you will need to pay the maximum stamp duty of $500. This will be on top of the buyer’s stamp duty paid for at Stage 3.

Home Protection Scheme (“HPS”) Insurance

HPS is a mortgage-reducing insurance scheme by the CPF Board. You need to be insured under HPS if you want to use your CPF Ordinary Account savings to pay your monthly installments.

The premium amount depends on factors such as your declared percentage of coverage, loan amount, age and gender. Using CPF’s HPS Premium Calculator and assuming:

- You are a 30 year old male

- You took up a $150,000 loan amount

- Your loan is a 22-year tenor

Your annual payable HPS Premium would be $120.

Fire Insurance

HDB’s current appointed insurer is FWD Singapore Pte Ltd. Fire Insurance for a 4-room flat will cost you $5.94 (inclusive of GST) for a 5-year premium.

| Flat Type | 5-Year Premium (Including 7% GST) |

| 1-Room | $1.62 |

| 2-Room / 2-Room Flexi | $2.71 |

| 3-Room | $4.87 |

| 4-Room | $5.94 |

| 5-Room | $7.13 |

| Executive Flat | $8.10 |

Total amount lost: $74061.26

In addition, you lose all your first-timer applicant privilege, which makes it harder to apply for and get a flat in subsequent ballots. See: Breaking up after only completing Stage 1: Application.

Breaking up after reaching the MOP

After the MOP of 5 years has passed, you are your spouse are free to mutually agree on what should happen to the HDB flat after divorce.

For instance, one spouse may agree to transfer their interest in the flat to the other spouse in return for some remuneration.

Alternatively, both of you may decide to sell the flat and split the sale proceeds in a certain proportion.

This means that the amounts you would have to pay for are the depreciated values of the flat (if applicable) and the remainder of the housing/bank loan (if applicable).

If you and your spouse are unable to agree on what should happen to the HDB flat after the divorce, the court will decide how to deal with it for you. This is provided, the flat is a matrimonial asset.

Examples of orders the court may make include requiring one spouse to transfer their interest in the flat to the other spouse, or ordering the flat to be sold with proceeds divided between parties in a certain proportion.

If you were granted the flat, then great! However, whether you can retain the flat will depend on your eligibility to do so. Per HDB’s website, one way to retain the flat is if you have custody of the child(ren) (including care and control).

If you have no children from your marriage, you can take over the flat under the Single Singapore Citizen (SSC) Scheme or choose to include another person to retain the flat.

Alternatively, you can sell the flat in the open market since your MOP requirement has already been satisfied.

Conclusion

As are most things in life, relationships (and marriage) are far from predictable. And while breakups are hard, it is even more so when there’s a BTO flat involved.

Take a second to think things through and communicate with your partner before you apply for a BTO together to potentially save yourself from getting into financial troubles on top of a painful heartbreak.

Of course, if you have already gone through with the BTO and are starting to regret it, our experienced Singapore divorce lawyers will be able to guide you through and out of this difficult time.

We’re here for you

When you contact our matrimonial law team, we will provide you with a consultation, tailored to your specific circumstances and goals in mind.

Our goal is to help you find a resolution that works for you.